Understanding the intricacies of tax exemptions for nonprofit organizations can be overwhelming, especially when navigating the IRS 501c3 requirements. For those operating within the nonprofit sector, securing and maintaining tax-exempt status is crucial for operational efficiency and financial stability. This comprehensive guide delves into the nuances of IRS 501c3 tax exemptions, exploring everything from eligibility criteria to compliance strategies. Whether you’re seeking information on tax-exempt status requirements or looking to streamline your nonprofit’s financial operations, this article offers valuable insights and practical advice to help you navigate the complexities of nonprofit taxation. By examining key aspects such as tax implications for employees, state-specific exemptions, and property tax considerations, this resource empowers you to make informed decisions that align with your organizational goals. From understanding the differences between 501c3 and 503c statuses to learning how to maintain your nonprofit’s tax-exempt status, this guide serves as an essential tool for anyone involved in the management of nonprofit entities.

Key Takeaways

– Understanding IRS 501c3 Tax Exemptions: Nonprofits are tax-exempt under IRS 501c3, but this doesn’t automatically affect individual tax rates for employees.

– Tax Implications for Nonprofit Employees: While nonprofits aren’t taxed federally, they may still withhold federal and state payroll taxes, and self-employment taxes can apply for independent contractors.

– Tax Breaks Through Charitable Donations: Donating to IRS-recognized 501c3 nonprofits can reduce taxable income, with cash donations fully deductible and non-cash gifts eligible under specific conditions.

– Documentation and Record-Keeping: To claim deductions, maintain detailed records, including receipts, appraisals, and acknowledgment letters from the nonprofit.

– Popular Nonprofits: Support organizations like Feeding America, Greenpeace, and local American Red Cross chapters to maximize tax benefits while contributing to meaningful causes.

What Makes a Nonprofit Tax-Exempt?

A nonprofit organization becomes tax-exempt under the Internal Revenue Code (IRC) by meeting specific requirements outlined in IRC Section 501(c)(3). Here’s a breakdown of the key factors:

- Exclusively Purposed Organization : The nonprofit must be organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, educational, or other specified purposes.

- No Profit Distribution : Nonprofits cannot distribute profits to owners or shareholders. Their net earnings must solely benefit the organization and its mission.

- Legal Registration : The organization must file an application with the IRS, typically through Form 1023, to obtain tax-exempt status.

- Public Benefit : The nonprofit must serve a public or private benefit, not just a limited group of individuals.

- Exclusivity of Activities : The organization’s activities must be open to the public or a broad segment of society, not restricted to a select group.

- Reliance on Contributions : Nonprofits depend on donations, grants, and contributions, which are often tax-deductible for donors.

- Compliance with IRC Requirements : The organization must comply with additional regulations and guidelines set forth by the IRS to maintain tax-exempt status.

By meeting these criteria, nonprofits qualify for tax-exempt status, enabling them to focus on their missions without paying federal income taxes.

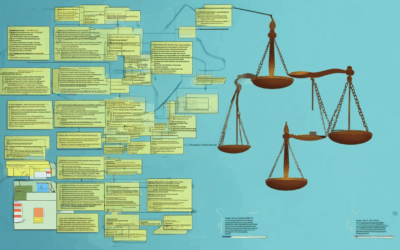

Understanding the Difference Between 501(c) and 501(c)(3) Organizations

A 501(c) organization and a 501(c)(3) organization are both types of tax-exempt entities in the United States, but they have distinct characteristics and purposes. Below is a detailed comparison:

- Purpose: – 501(c): A 501(c) organization is a private foundation that can receive contributions and distribute funds to qualified charitable organizations. It focuses on grant-making activities rather than operating programs directly. – 501(c)(3): A 501(c)(3) organization is a public charity that can also receive contributions and engage in a wide range of activities, including operating programs, providing services, and conducting research.

- Tax Implications: – 501(c): As a private foundation, a 501(c) organization must pay federal income tax on its net income, unless it qualifies for certain exemptions. It cannot offer donors a tax deduction for contributions. – 501(c)(3): A 501(c)(3) organization is eligible to receive contributions that donors can deduct on their federal income tax returns, subject to IRS rules. It also pays no federal income tax on its net income.

- Donor Benefits: – 501(c): Donors to a 501(c) organization generally cannot claim a tax deduction for their contributions, though there may be state-specific rules. – 501(c)(3): Donors to a 501(c)(3) organization can claim a tax deduction for their contributions, provided the organization qualifies as a “public charity” and meets other IRS requirements.

- Operational Flexibility: – 501(c): A 501(c) organization has greater operational flexibility compared to 501(c)(3) organizations, as it can focus solely on grant-making without the need to diversify its activities. – 501(c)(3): A 501(c)(3) organization must maintain a broader range of activities to qualify as a public charity, which can limit its ability to specialize in grant-making.

Both types of organizations play crucial roles in supporting charitable initiatives, but they cater to different needs and operational goals within the nonprofit sector.

IRS Exemption Form for Non-Profit Organizations

The IRS provides specific forms for non-profit organizations to apply for tax-exempt status. The primary form used is:

- Form 1023: Application for Recognition of Exemption Under Section 501(c)(3) – This is the standard form for most organizations seeking tax-exempt status under Internal Revenue Code (IRC) Section 501(c)(3). This includes organizations such as charities, religious groups, educational institutions, and cultural organizations.

- Form 1023-EZ: Streamlined Application for Recognition of Exemption Under Section 501(c)(3) – A simplified version of Form 1023 available for eligible organizations. This form is typically used by smaller organizations or those meeting specific criteria, such as being a church, school, or tribal government.

Eligibility and Requirements

- Form 1023: Requires detailed information about the organization’s mission, activities, governance, and financials. It is suitable for most non-profits but involves a more extensive application process.

- Form 1023-EZ: Designed for organizations that meet specific criteria, such as having annual gross receipts below certain thresholds or operating as a tribal government. This form simplifies the application process.

Both forms must be filed with the IRS to obtain tax-exempt status, enabling the organization to avoid paying federal income tax and allowing donors to deduct contributions.

For more details, visit the IRS website .

Do you get taxed differently if you work for a nonprofit?

Working for a nonprofit organization does not change your federal income tax rate compared to working for a for-profit company. Here’s a breakdown of how taxes work for nonprofit employees:

- Federal Income Tax: As a nonprofit employee, you typically pay federal income tax based on your taxable income, which includes wages, dividends, and other reportable compensation. Nonprofits are generally exempt from federal income tax, but this does not apply to individual incomes.

- Payroll Taxes: Nonprofits may not pay federal employment taxes for their employees, meaning you likely won’t have federal income tax withheld from your paycheck. However, this depends on the nonprofit’s classification under IRS tax-exempt rules.

- State Taxes: State tax laws vary, so your tax rate and obligations will depend on your state of residence. Some states may require you to pay state income tax even if you work for a nonprofit.

- Self-Employment Taxes: If you’re considered self-employed by the IRS (common in smaller nonprofits), you’ll be responsible for paying both federal and state self-employment taxes.

It’s important to note that while nonprofits are tax-exempt, they may still have obligations such as filing Form 990 or other tax documents. For personalized advice, consult a tax professional familiar with nonprofit taxation.

Do you get a tax break if you work for a nonprofit?

Working for a nonprofit organization does not automatically qualify you for a tax break, but there are specific rules regarding taxes for nonprofit employees. Here’s a breakdown of how taxes work for individuals employed by nonprofits:

- Federal Payroll Taxes: Nonprofit employers are required to withhold federal income tax, Social Security, and Medicare taxes from their employees’ wages, regardless of income level. These taxes are deducted from your paycheck and sent to the IRS.

- State Payroll Taxes: State taxes may vary. Some states offer exceptions for nonprofit employees, while others require payment of state income tax regardless of the employer’s tax-exempt status. For example, California allows certain income levels to be tax-free for nonprofit employees, while other states may not.

- Income Limits for Exemptions: In some cases, if your total income from the nonprofit is below a specific threshold (e.g., $108.28 annually in 2023), you may not owe Social Security and Medicare taxes. However, this varies by state and depends on the type of nonprofit.

Always consult with a tax professional or refer to the IRS guidelines for the most accurate and updated information regarding your specific situation. Tax laws are subject to change, and exceptions may apply based on your residency and the rules of your state.

Can Giving to a Nonprofit Lower Your Taxable Income?

Yes, giving to a nonprofit can lower your taxable income through tax-deductible donations. Here’s how it works:

How Charitable Donations Affect Your Taxes

- Donations to IRS-recognized nonprofit organizations are typically tax-deductible.

- You must ensure the nonprofit is a registered 501(c)(3) charity to qualify for a tax deduction.

- No goods or services of substantial value may be received in return for the donation to claim a tax deduction.

Types of Deductible Donations

- Cash contributions to qualifying charities are fully deductible in the year they are made.

- Non-cash gifts, such as goods or services, may also be deductible depending on their fair market value and appraisal methods.

- For non-cash items valued over $500, a qualified appraisal and completed Form 8283 must accompany your tax return.

Claiming Your Donation on Tax Return

- Report charitable donations on Form 1040 under “Itemized Deductions.”

- Keep detailed records, including receipts, appraisals, and acknowledgment letters from the nonprofit.

- The IRS requires accurate documentation to support your claimed deductions.

Examples of Popular Nonprofits

- Feeding America supports food distribution efforts nationwide.

- Greenpeace focuses on environmental conservation and advocacy.

- Local chapters of the American Red Cross provide disaster relief and community support.

Limits and Considerations

- Not all donations are tax-deductible, especially those lacking proper documentation.

- Contributions to foreign organizations may require additional steps to qualify for U.S. tax deductions.

- Always verify the nonprofit’s tax-exempt status before donating to avoid penalties.

Conclusion

Giving to a nonprofit can indeed lower your taxable income by allowing you to claim tax-deductible donations. Just ensure you understand the rules, keep accurate records, and verify the nonprofit’s eligibility for tax deductions. This not only supports a noble cause but also provides financial benefits for you.

0 Comments